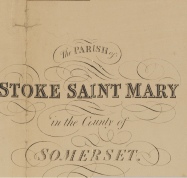

STOKE ST MARY, SOMERSET, ENGLAND

STOKE ST MARY HISTORICAL RECORDS

The History of Tithes

Originally, tithes were payments in kind (crops, wool, milk etc.) comprising an agreed proportion of the yearly profits from farming, and made by parishioners for the support of their parish church and its clergy. In theory, tithes were payable on (i) all things arising from the ground and subject to annual increase -

During the dissolution of the monasteries, much church land -

From early times money payments began to be substituted for payments in kind, a tendency further stimulated by enclosures, particularly the parliamentary enclosures of the late18th century.

On the wall of Stoke St. Mary Church is a board which reads as follows:

The Owners and Occupiers of land in the Parish of Stoke St, Mary are entitled to the following

Modus or Customary charges in lieu of their tithes paid at Easter yearly.

For every acre of Grass in the Parish in lieu of the Tithe of Hay

For every calf reared in the Parish

For every Cow milked in the Parish in lieu of Tithes of Milk

For every Hogshead of Cider made in the Parish

For every Garden in the Parish

For the fall of every Colt in the Parish

For every score of Sheep fed in the Parish

but not shorn in the said Parish in lieu of

adjustment of Tithe and growth of Wool.

Thus were the parsons paid by their parishioners.

Tithe commutation from 1836

In 1836, the government decided to commute tithes (i.e. to substitute money payments for payments in kind) throughout the country.

Tithe apportionments

In most cases, the principal record of the commutation of tithes in a parish under the Tithe Act 1836 is the Tithe Apportionment. Strictly speaking, the tithe apportionment and the tithe map together constitute a single document, but they have been separated to facilitate use and storage.

Most apportionments follow the general pattern set out in the instructions which were issued at the time. The standard form of apportionment contains columns for the name(s) of the landowner(s) and occupier(s) (because until the passing of the Tithe Act 1891 the payment of tithe rentcharge was the owner's liability); the number, acreage, name or description, and state of cultivation of each tithe area; the amount of rentcharge payable, and the name(s) of the tithe-

TITHE APPORTIONMENT

The Complete list

Click on the picture

2d

4d

3d

6d

2d

1/-

4d